ICD participated in Malaysian Support for COP29 event

- Institute of Corporate Directors

- Dec 9, 2024

- 5 min read

By: Aubrey Camille J. Perez

Research and Content Coordinator

Institute of Corporate Director

The Institute of Corporate Directors (ICD) actively participated in the Malaysian Support for COP29 event, organized by Climate Governance Malaysia (CGM) and held from November 12 to 21 in conjunction with the Malaysia Pavilion at COP29 in Baku. The event brought together global experts to showcase collaborative efforts and strategies for addressing climate change.

Representing ICD Philippines as panelists were Mr. Dennis Montecillo, FICD; Ms. Sarah Fairhurst, FICD; and Mr. Valentino Bagatsing, FICD. They contributed valuable insights during key discussions on critical topics such as energy transition, transition finance, and climate resilience.

Boards’ Role in Energy Transition (November 13)

The session opened with keynote speaker Sharath Martin, a member of the board of trustees of the Shift Project, who highlighted the crucial role of human rights in addressing climate change and energy transitions. Mr. Martin referenced the UN resolution of July 2022, which recognized the right to a clean, healthy, and sustainable environment. He urged businesses to align with the UN Guiding Principles for Business and Human Rights, particularly concerning greenhouse gas emissions in their operations and value chains.

Mr. Martin introduced the concept of a "just transition," stressing that the shift to cleaner energy must not greatly harm vulnerable communities. He pointed out that groups such as children, the elderly, outdoor workers, women, and indigenous people are especially at risk from climate change, facing challenges like land displacement and increased exposure to extreme weather events and health risks. While the clean energy sector could create millions of jobs by 2050, Mr. Martin cautioned that workers in fossil fuel industries also face risks and encouraged businesses to consider the economic and social implications of this transition and engage in stakeholder consultations.

Mr. Dennis Montecillo, FICD, reflected on his experiences serving on boards in various sectors, including real estate and healthcare, during the panel discussion. He noted that large companies are leading the way in committing to the energy transition, though some corporations hesitate due to perceived high costs. Mr. Montecillo emphasized that the "who pays" question is critical in this transition, with companies needing to take responsibility for the environmental impact of their actions.

Mr. Montecillo suggested that sustainability should be embedded in a company’s mission and governance. He highlighted the need for boards to move beyond treating corporate social responsibility as a minor department, advocating for it to be a central part of the corporate strategy. He also stressed the importance of governments and the private sector working together, with clear and collaborative regulations to accelerate the clean energy transition.

Boards’ Role in Transition Finance (November 18)

The sixth day of the event started with keynote Mr. Dinagaran Chandra, head of ESG Investments at Permodalan Nasional Berhad (PNB), addressing the importance of institutional investors in driving sustainability. He outlined how Malaysia’s Voluntary Carbon Market plays a crucial role in funding decarbonization projects, such as reforestation and carbon capture. Mr. Chandra also discussed PNB's commitment to achieving net-zero emissions by 2050, along with its focus on reducing carbon intensity across its portfolio and its investments in green and transition assets. He stressed that high-integrity carbon markets are vital to ensuring that corporate sustainability efforts are both impactful and effective.

Mr. Henry Soediarko, senior portfolio manager at the Climate Impact Asia Fund, is the second keynote for the session and he spoke on the investment opportunities emerging from the climate transition. He highlighted that sectors like renewable energy, green mobility, and energy efficiency are essential to reducing emissions and creating jobs. Mr. Soediarko also pointed out the growing importance of carbon markets in financing decarbonization projects. He emphasized that companies in the green sector, such as those in electric vehicle manufacturing, are already outperforming traditional industries, presenting strong opportunities for investment. Mr. Soediarko also discussed the role of the Climate Impact Asia Fund, which invests in leading companies across Asia-Pacific with a focus on decarbonization, ensuring a positive environmental impact while delivering strong returns.

In the panel discussion, Ms. Sarah Fairhurst, FICD, shared insights from her experience in both the fossil fuel and renewable energy sectors. She discussed the complex decision-making process boards face when managing legacy assets like coal-fired power stations while transitioning to cleaner energy. Ms. Fairhurst noted that strategic planning is essential for boards to balance financial interests with environmental responsibility. She also highlighted the need for alignment between government policies, corporate strategies, and regulatory frameworks to eliminate barriers and accelerate the clean energy transition. In addition, Ms. Fairhurst discussed how institutional investors can leverage their influence to support green transitions and climate policies. She emphasized the importance of adopting a flexible approach, backing projects with transitional phases that contribute to long-term sustainability, noting that not every project will be fully green from the outset but can still play a significant role in reducing emissions over time.

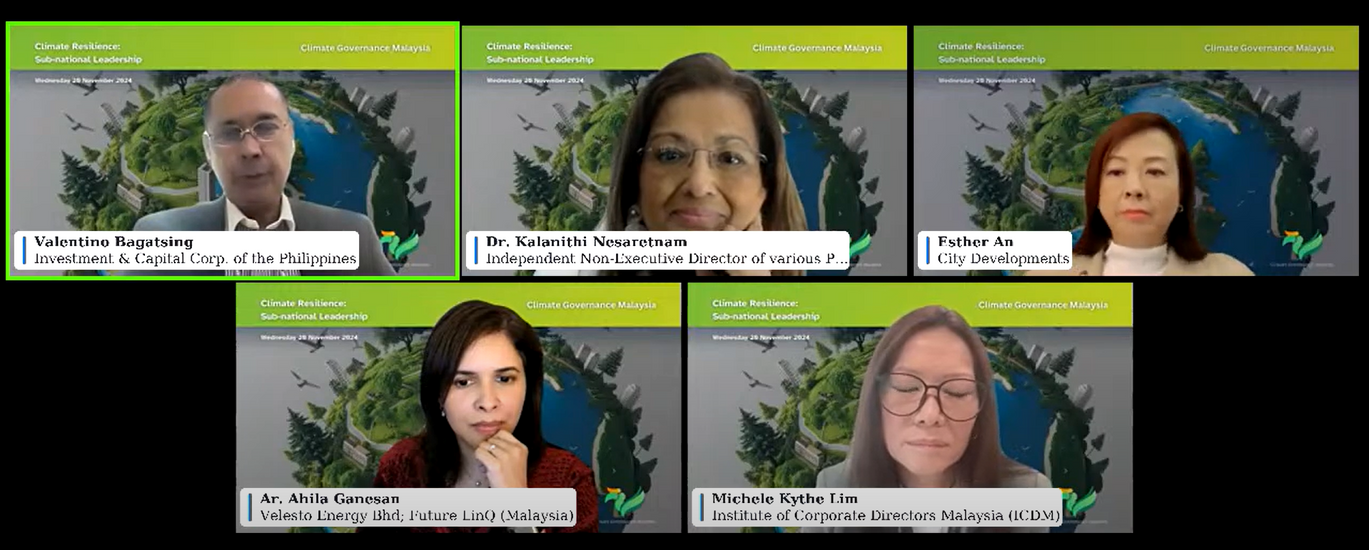

Board’s Role in Climate Resilience (November 20)

Day 8 of the program featured a keynote by Ms. Narae Choi, senior urban specialist at the World Bank Malaysia, who highlighted the crucial role cities play in climate action. Ms. Choi explained that cities, contributing around 70% of global carbon emissions, are highly vulnerable to climate impacts. She emphasized the importance of both mitigation and adaptation strategies, stressing that cities must not only reduce carbon emissions but also build resilience to climate risks like flooding and heatwaves. Efficient planning, strong institutions, and innovative financing were identified as key enablers of climate action at the city level, ensuring that urban areas can transition towards sustainability.

Mr. Valentino Bagatsing, FICD, is part of the discussion in the second panel. He shared insights on integrating climate resilience into corporate strategies. Bagatsing emphasized that climate risks should be viewed through a risk management lens, urging businesses to make informed decisions that prioritize resilience. He suggested incorporating climate resilience into Key Performance Indicators (KPIs), likening it to mandatory training such as anti-money laundering. According to Mr. Bagatsing, boards should take an active role in guiding their organizations’ efforts to mitigate climate risks, ensuring that climate considerations are embedded in all decision-making processes.

Mr. Bagatsing further stressed the importance of innovation in addressing climate resilience. He suggested that businesses should embrace emerging technologies and practices to improve their adaptability to climate change. By integrating climate resilience into governance, companies can better manage risks and contribute to long-term sustainability. His call for a "carrot and stick" approach in governance was a key takeaway, urging both regulatory frameworks and multilateral interventions to accelerate climate action and resilience efforts.

You can watch the full recordings of the online sessions featuring Mr. Dennis Montecillo (Day 2), Ms. Sarah Fairhurst (Day 6), and Mr. Valentino Bagatsing (Day 8) through this [link].

%20(1).png)

Comments